Uber’s Third Quarter 2022 Results: A New Look at the Books

Arand/iStock via Getty Images

Insight

Uber (New York stock market :UBER) is a company we all know. Often ending up in the news for the wrong reasons, it’s fair to call Uber a top company; his name has come associated with everything from potential work conflicts, aggressive business practices and the whims of its founder Travis Kalanick.

News cycle aside, many of us know the company from using one of its services – Uber Cab, Uber Eats, or perhaps one of its lesser-known offerings such as Drizzly (delivery of alcohol).

This large and growing B2C logistics company, still less than 15 years old (founded in 2009), has been a polarizing company and most certainly a polarizing stock. A wide range of investors, both professional and retail, seem to have an opinion – those opinions being at both ends of the bearish/bullish spectrum.

Given the company’s double-digit rise (12.5% as of this article) Q3 2022 resultsI want to take a fresh “look at the books” and determine the fundamental position of the company as it currently stands.

Fundamentals

Pricing

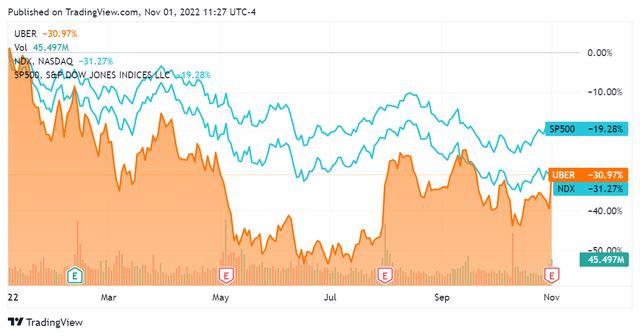

Starting from a bird’s eye view, we see that Uber has performed roughly in line with the Nasdaq this year, which is down about 11% more than the SP500 year-to-date. .

SeekingAlpha.com UBER 01/11/2022

While Uber has underperformed the NASDAQ for most of the year, today’s sharp rise has the stock in line with NASDAQ’s year-to-date price performance. This provides us with a reasonable benchmark to further analyze the price behavior of this instrument.

Over the past year, Uber’s underlying business metrics have evolved. Let’s take a look at the third quarter 2022 results and see how they line up with historical metrics and expectations.

Reservations and gross revenue

Gross bookings represent Uber’s overall economic impact, with revenue being the portion that accrues to the company. Since Uber is a business that provides services through contractors, the difference between gross bookings and revenue is the compensation of those contractors.

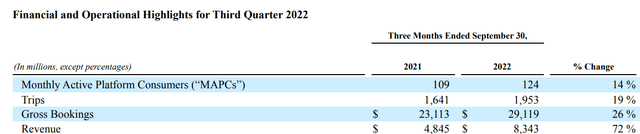

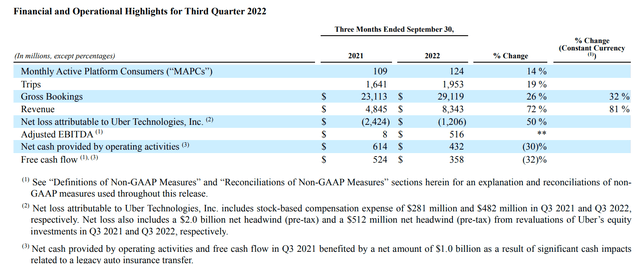

SEC UBER 8-K 11/1/2022

Looking at the company’s 11/1/2022 8-K (results for Q3 2022), we see continued double-digit growth in bookings and revenue. Gross bookings are 26% higher for the third quarter of 2022 than they were in 2021, growing from $23 billion to $29 billion.

This is supported by the main metric in the image above: Platform Monthly Active Consumers. Monthly active users are the lifeblood of any B2C technology company, and Uber is no exception. It’s good to see that this metric continues to rise, which is far from a given in the tech industry today. A 14% growth from 109 million quarterly users to 124 million can be considered healthy.

Since the percentage growth in gross bookings exceeds MAPC growth, this implies that each active customer/user is also spending more on the platform than before. Moreover, it appears that Uber captures a larger share of economic activity than it generates – revenue growth significantly outpaces growth in these other measures. This is mentioned in the company’s current file and will be explained in the next section.

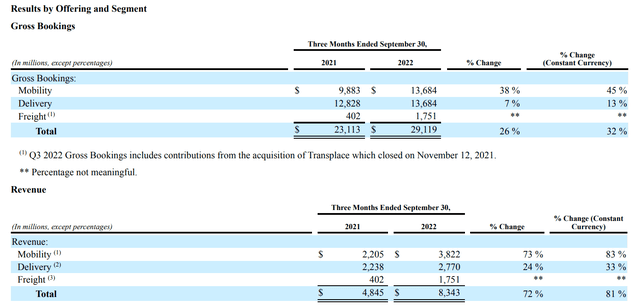

Looking at Uber’s performance by business, we see a picture of growth in its 3 main areas. Uber’s core business, mobility, shows particularly robust growth of 38% compared to Q3 2021:

SEC UBER 8-K 11/1/2022

In addition, we see a strong increase in revenue in all 3 business areas of the company. The filing makes clear that part of this is due to one-time adjustments related to its acquisition of Transplace, a digital freight management system similar to Uber Freight. Along with that, the filing says $1.1 billion in mobility revenue was added due to changes in the company’s operating model in the UK. While we won’t go into the details of the company’s UK operations in this article, this move should reassure Uber’s ability to generate returns in a more regulated labor environment such as the UK. .

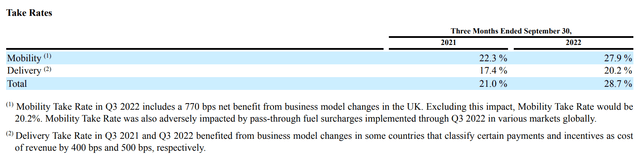

Since these numbers were significantly impacted by one-time accounting adjustments, it’s also worth looking at the company’s “catch rate” in each of its lines of business. This represents the share of gross bookings that impacts business revenue:

SEC UBER 8-K 11/1/2022

Minor tweaks aside, these numbers are moving in the right direction. The Total Take Rate going from 21% in Q3 2021 to more than 28% in Q3 2022 is a good indicator of the company’s ability to capture value.

Overall, it’s fair to see that this represents a healthy revenue picture for the company. Double-digit growth in users, bookings and revenue isn’t easy to sustain at Uber’s scale; yet it seems to do so.

Profitability and cash flow

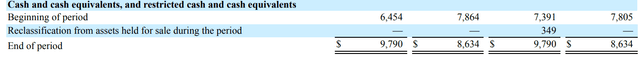

Of course, good revenue growth wouldn’t mean much without a commensurately strong cash flow. Uber’s profitability and cash position warrant examination:

SEC UBER 8-K 11/1/2022

The company still shows a net loss. However, its $1.2 billion quarterly loss was compounded by several factors. The company’s stock-based compensation charge of $482 million was significant, along with a negative $2.5 billion revaluation of its equity investments.

It’s common for Uber to write down its equity investments, and it’s happened several times in its operating history. Unfortunately, that seems to have made the difference to net income this quarter. Nevertheless, noting bad investments is essential and creates certain tax efficiencies. This leaves the door open to net profit further down the line; something that would have been achieved in the last quarter without these adjustments. Note that these are measures defined in the context of accrual accounting; we will then examine the cash position.

On the cash flow side, Uber provided a quarter of positive free cash flow. While the comparison is made for the third quarter of 2021, the 8-K clearly indicates that the company’s free cash flow was impacted by another one-time adjustment relating to insurance. That means the year-over-year decline in free cash flow we’re seeing isn’t worth the read, since last year’s quarter was an exception. However, this quarter is “clean” in the sense that it is operating cash and is not subject to any adjustments. It is indeed a good sign.

By looking at the cash position in more detail, we can avoid the complex accounting inherent in a technology company and simply look at the company’s cash position:

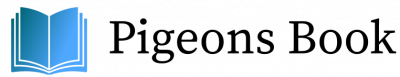

SEC UBER 8-K 11/1/2022

SEC UBER 8-K 11/1/2022

(Top/bottom of table assembled from UBER 8-K 11/1/2022)

The situation here appears stable, with Uber able to improve its cash position on both an annual and quarterly basis.

Conclusion

On a fundamental basis, Uber just posted a quarter that inspires optimism: double-digit revenue growth, a genuinely positive cash flow quarter and a strengthening cash position.

There’s a lot more to cover with a business like this, but the essence of the business here is most definitely robust. Given that the stock price is in line with the NASDAQ index for this year and is showing strong fundamental momentum through 2023, I am bullish on the company and the stock.

/cloudfront-us-east-1.images.arcpublishing.com/gray/LMS4GGRVH5AB5IAHCD22D6S3SA.jpg)