Beware Of Really Clever Doomsday Merchants Selling Books

One of the world’s most famous historians, Niall Ferguson, has suggested that “the world is sleepwalking into an era of political and economic upheaval similar to the 1970s – only worse.” CNBC Karen Gilchrist informs us.

Ferguson was a professor at Harvard and wrote something like 16 books, with his latest titled “Doom: The Politics of Catastrophe.”

Ferguson is a qualified historian but not an economist, but he is always happy to offer his best guesses about what lies ahead.

As someone who tries to water the views of extremists (who make headlines and sell books) because I have to talk to our consulting clients, subscribers, listeners, viewers and followers about the investment, I sometimes had to evaluate Ferguson’s big call strategy.

Although he’s right, he’s wrong, but my colleagues in the media don’t seem interested in reminding us that he’s fallible.

So what does Ferguson say about the 1970s that could be repeated? “Last year’s monetary and fiscal policy mistakes, which triggered this inflation, are very much like those of the 1960s,” he said, comparing recent price increases to the stubbornly high inflation of the 1960s. 1970. “And, like 1973, you get a war,” he continued, referring to the 1973 Arab-Israeli War (also known as the Yom Kippur War) between Israel and a coalition of Arab States led by Egypt and Syria.

He’s probably right that “this war lasts much longer than the 1973 war, so the energy shock it causes is actually going to be more sustained”, but how the world reacts today could be very different. of the world 50 years ago. from.

As an economist who is interested in economic history, I know that the economic world of 1973 is very different from that of 2022. The political events might be similar, but today’s world is no longer overly regulated with nationalistic tariffs and protections. Unions have less power and therefore a wage-price spiral is less likely, which reduces the risks of stagflation, with both rising inflation and unemployment.

The financial system is more deregulated, money markets are sending signals to central bankers and governments like never before. And the internet has created a world that means competition has intensified to such an extent that if workers want to ransom their employers, they could lose jobs to rivals in Asian countries.

Economists say there have been structural changes in our economies, which means that what we thought was a relationship in the economy may not work as it used to. For example, once upon a time when a bank raised its interest rates, we all paid higher rates. However, since the 1990s, products such as fixed-rate loans, interest-only loans, and clearing accounts have changed the way monetary policy works.

Here is another example from the RBA’s financial stability review of securitization data which indicates that the median excess payment cushion for homeowners with a variable rate mortgage was around 21 months of repayments expected in 2022, compared to approximately 10 months at the start of the COVID-19 pandemic.

This was not the case in the 1970s.

Our new world of borrowers has created buffers that actually help those in debt cope with rising interest rates, which affects the success of monetary policy.

What I’m trying to say is that Ferguson’s comparison in the 1970s of similar political events could occur in a very different economic world.

The story that I have been writing since 1985 in the media has seen four stock market crashes:

- 1987

- The dotcom crash of 2000-01

- The 2008 GFC

- The coronavirus crash of 2020.

But the world’s economies and stock markets have held their own.

We are big troublemakers. The worst thing you can do is overreact and make investment decisions based on doomsday predictions that mean you lose. And this chart shows why investing in real estate over the past 25 years has been a good idea.

Real estate prophets have been telling us for decades to beware of a bubble bursting. One day it probably will, but these doomsday merchants have had “a long string of failures” with their predictions. As reported by urban.com.au, “Jeremy Grantham, co-founder of Boston-based hedge fund GMO, caused a stir in April 2010 when he declared a housing bubble in Australia and said prices would plummet. as interest rates rise. [the Reserve Bank pushed rates up by 25 basis points to 4.25% in April 2010].”

If you listened to Jeremy, you missed 12 years of a 25-year bull run for house prices. You would also have missed last year, which saw national average house prices rise 22%, their fastest 12-month increase since 1989!

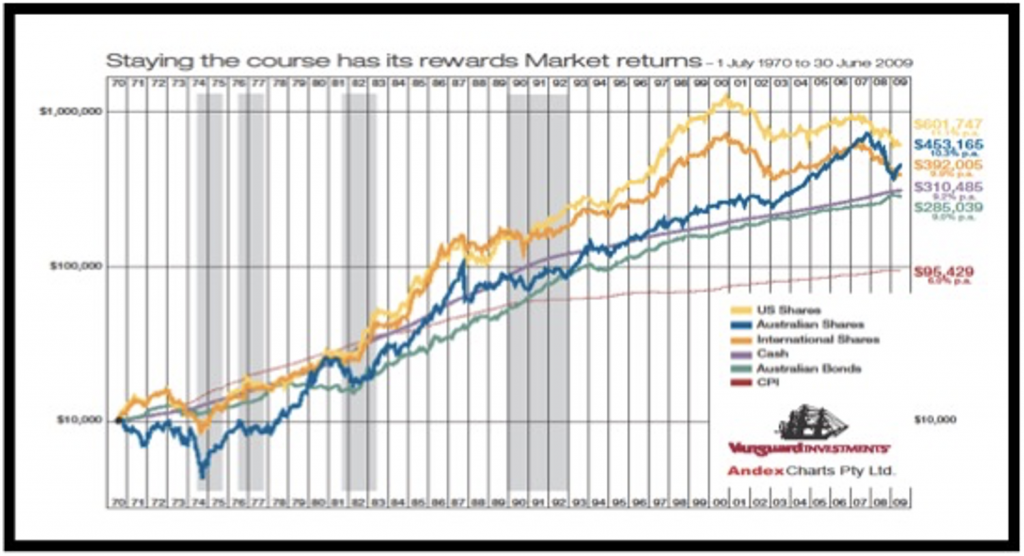

Whenever a pessimist makes me nervous, I go back to this Vanguard chart of someone invested in All Ords and reinvesting dividends from 1970 to 2009. That was a year after the GFC crash sent the 50% shares. Even with that, and the crash of 1987 and the dotcom crash, $10,000 invested and cleared to roll turned into $453,542!

It’s the return on investing in quality assets and trusting in the power of economies, corporations, governments and central banks that all manage to deliver returns of around 10% a year over a decade.

Some decades it might be less and in others it might be higher, but one history lesson that Niall Ferguson doesn’t push is one that smart investors (like Warren Buffett) have been telling us about for decades – invest in quality assets, be greedy when others are scared and “our favorite holding period is forever”. But remember, Buffett was talking about quality assets – these have the ability to survive doomsday scenarios.

/cloudfront-us-east-1.images.arcpublishing.com/gray/LMS4GGRVH5AB5IAHCD22D6S3SA.jpg)