There are many things a person can do with their money. First, they can spend it. Many of us do it all the time, probably more than we should (just me?). Second, you can save it in a mattress, a banana holder or a savings account. We all know it makes sense to save our money, but where to save it is often a conundrum. And this is where the third general category of “what to do with money” comes into play: investing. Reading some of the best books to learn more about investing is a good place to start if you choose this option.

Unless you’re putting real money into a mattress (please don’t), your savings are likely invested to some degree. A good savings account in the US has an interest rate of around 0.5-1.0% Annual Percentage Yield (APY), and as such you get a very small return on your money for letting the bank hold it and use it to make more money. In short, it is investing. You give your money to the bank and they give you back some more.

“But Tika!” I hear you say. “I’d rather get A LOT more in return for giving someone the privilege of trusting them with my money. I’d also like to someday retire and pretend to escape capitalism, maybe somewhere sunny or with “killer powder. Have no fear! Although working in the world of finance, I have next to no understanding of investing – a rather embarrassing confession. Putting together this list of the best books to learn more about investing was a very helpful starting point.There are many different places you can choose to invest your money, so I’ve divided the suggestions into two general categories.

The “markets:” stocks, funds, et al.

rich dad, poor dad by Robert T. Kiyosaki

When rich dad, poor dad was first published in 1997, my own father immediately sent me a copy which followed me from apartment to apartment – unread – until I finally donated it at some point. My brother, on the other hand, in fact Lily his copy and is now comfortably invested and owns both a home and a rental property.

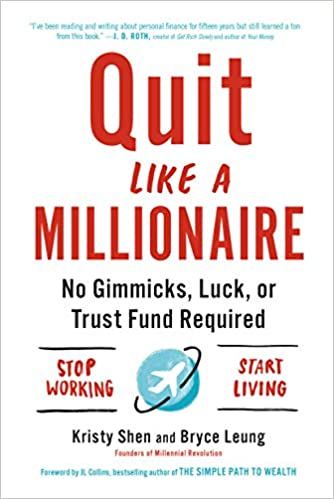

Quit like a millionaire by Kristy Shen and Bryce Leung

Kristy Shen and Bryce Leung are leaders of the Financial Independence, Retire Early (FIRE) movement. They present a mathematical and reasoned approach to managing your money so that you too can retire before you turn 65.

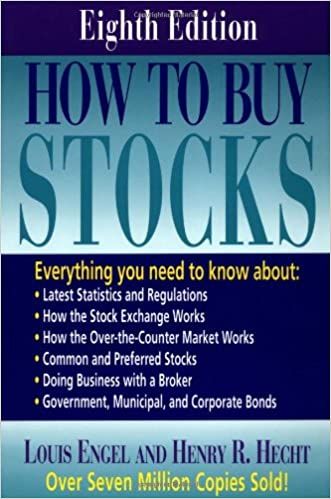

How to buy stocks by Louis C. Engel and Henry R. Hecht

Engel wrote the first edition of this primer on the investment market in 1957. The last edition was published in 1994, which explains the cover. How to buy stocks remains important because, while the mechanics of buying shares have changed, the underlying process really hasn’t. Understanding the system is key to making it work for you.

Get good with money by Tiffany “The Budgetist” Aliche

Tiffany Aliche was laid off by the recession and lost her nest egg due to shady financial advice. While returning to financial independence, she has developed a 10-step plan that will help anyone assess their goals and what stands between them and achieving those goals. No matter where you are in your journey, The Budgetnista has great tips for you.

The Bogleheads’ Guide to Investing by Mel Lindauer, Taylor Larimore, et al.

John C. Bogle (1929 – 2019) was the founder of Vanguard and the “grandfather of index funds”. If you don’t know what an index fund is, this is a great place to start learning. The authors do not assume any prior knowledge of investing; their goal is to help the reader create a strategy from scratch. Bogle wrote the front; if you want to know more about the man himself, also check out his published works.

What to do with your money in a crisis: a survival guide by Michelle Singletary

German military strategist Helmuth von Moltke is famous for saying, “[n]o battle plan survives contact with the enemy. A good investment plan should be flexible enough to survive contact with the real world and all the economic gibberish that entails. Singletary is a financial columnist from an economically disadvantaged background and helps investors (that’s you!) build a plan that will help provide economic security.

I hope you (and I!) can take inspiration from this list of the best books to learn more about investing. Hopefully at least one of these books will show you how to work towards financial independence and teach you how you can retire early if that’s what you’re looking for. After all, if we don’t collectively retire early, how are we going to end up going through our TBR rosters? ! ?

If you’re looking for more investing books, you can check out the list of the 15 best investing books for new investors by Neha Patel, another Book Riot contributor.